Read this post to understand the complex cost components of a seller net sheet for a smooth home closing experience.

Real estate closing is a complex process for your clients to understand and go through. And the most complex part is to understand the various costs that sellers must pay at the time of closing.

Sellers often have an estimated amount in their minds that they are expecting to earn. However, due to the complexity of the transaction, they may end up with an amount that may be far less than they had been expecting from the sale. This is where you can step up and make things transparent for your clients. And the way to do that for your seller is to give them a comprehensive view of the costs using the seller net sheet.

Seller net sheet is one of the most important documents in the closing process meant exclusively for the seller alone. This is why It becomes important to understand this document and its cost components.

In this post, we are going to discuss the seller net sheet in detail. We will look into the numerous cost features within the seller net sheet, understand how different it is from the buyer net sheet, and also look at a few tools using which you can generate the seller net sheet for your clients.

Table of Contents

- What is a Seller Net Sheet?

- Seller Net Sheet vs. Buyer Cost Sheet

- What are the components of a seller net sheet?

- Who prepares the seller net sheet and when?

- What are some free tools to calculate cost components in the seller net sheet?

What is a Seller Net Sheet?

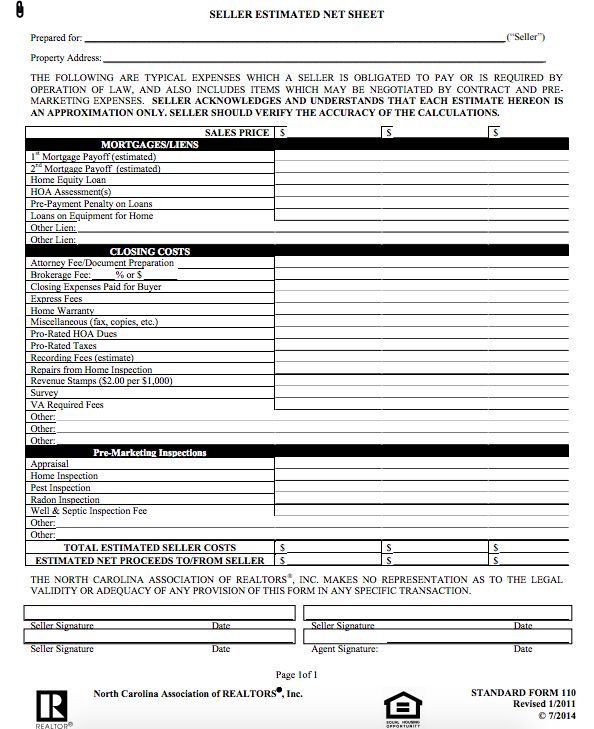

A seller net sheet is a vital document used in real estate closing that shows an estimated amount the seller would receive by selling their home after all the deductions. These deductions are nothing but the various costs deducted from the seller’s account during the closing process.

Costs related to the mortgage/ Liens. These cost components are paid by the seller for their existing mortgage or liens associated with the property. These costs could be home equity loans, HOA assessment, penalty on loans, and other costs. Legally, sellers are supposed to pay these costs before the title is transferred to the buyer’s name.

Closing costs. These cost components include attorney fees, repair costs, prorated taxes and dues, and various other costs required at the time of closing. Additionally, revenue stamps, costs for surveys, and recording fees are also included under closing costs as well.

Premarketing. Premarketing costs are spent on the closing process before the buyer and seller come together to sign the deal. These costs involve property and pest inspection fee. Additionally, home inspections and appraisals charges are also clubbed into premarketing charges.

Remember, that a number of costs listed under pre marketing costs could be paid by the buyer instead if both parties have negotiated and agreed to do so. This brings up the question of the division of the costs between the buyer and seller. What are the costs usually paid by the seller and the buyer respectively? The answer lies in finding the difference in cost components between the seller set sheet and the buyer cost sheet.

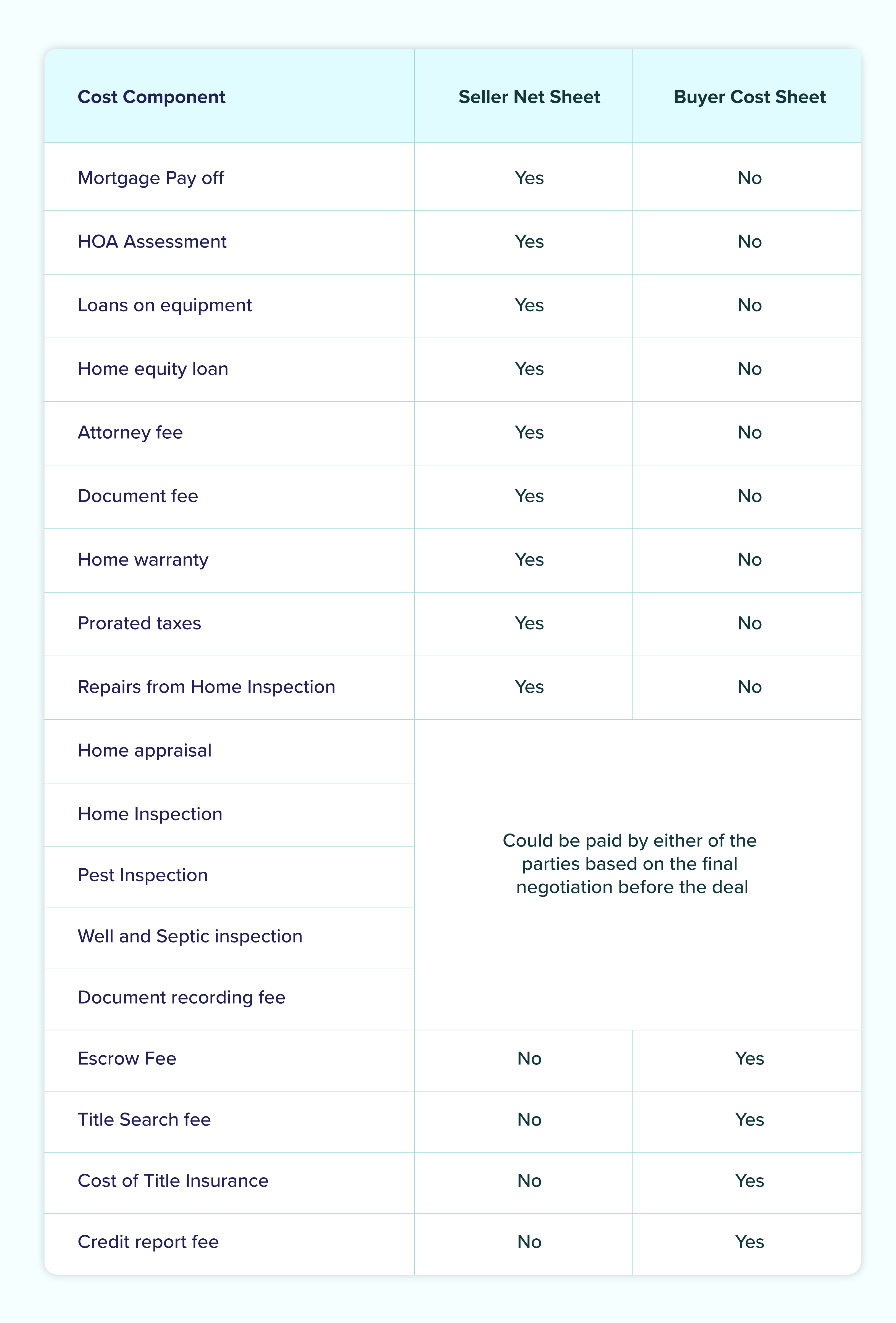

The following table briefly points out the differences that you may find between the two documents.

What's the difference between a Seller Net Sheet and Buyer Cost Sheet?

The following table demonstrates the differences between the two documents.

Now that we have clearly distinguished the costs between the two documents, let’s go back to the seller net sheet and break down the cost components in detail. We will take up the buyer cost sheet in another blog post.

What are the components of a seller net sheet?

Mortgage payoff by the seller. Mortgage payoff is the amount the seller owes to the financial institution and is obliged to pay the same. The payoff amount on the seller’s part could be adjusted between the seller and buyer and may extend a few months.

Home equity loan. Home equity loan is the amount that allows the homeowner (seller) to borrow against the equity or the current market value of the property. If the seller has opted for an equity loan, they are supposed to pay that amount before transferring the title to the buyer. Home equity loan is also called the second mortgage interchangeably.

HOA Assessment fee. The Homeowners association or HOA provides landscaping services such as mowing the grass, vendor services, and maintenance of the property. The seller must pay any pending HOA charges before the title is transferred to the buyer.

Prepayment penalty on loans. Penalty on loans is the amount levied on the sellers when they miss paying their monthly installment for a month or more. The seller must make sure that they pay these penalties before they sign the deal with the buyer.

Loans of equipment for home. If the seller has bought some home appliances or machinery on installments, they could carry them to their new homes or sell them to the buyer. In that case, the price is debited from the buyer’s account.

Other Liens. There could be other lines on the property such as mechanics lien that can be claimed by a contractor for any non payment or pending construction or labor charges. One could also have tax liens or judgment liens connected to their property. However, judgment liens are very rare.

Attorney Fee/ Documentation. Attorneys are compulsory in many US states to legally transfer the title from seller to buyer. An attorney may charge around $200/hr for their services. You may end up paying a consolidated cost of around $500-$1500 to the attorney. The price may vary depending on the time and complexity of the transfer. A disputed property may increase this cost component.

Brokerage Fee. The brokerage fee mostly goes to the listing agent, who can be the listing broker too, at the same time. Brokerage fees can go up to 5% of the total transaction value that the buyer is supposed to pay.

Closing expenses paid for the buyer. The buyer and seller often negotiate with each other before closing the deal. The buyer may agree to pay some part of the closing expenses on their own to compensate for some cost, initially paid by the seller in the form of renovations or other fixtures.

Express Fees. Express fees are incurred to expedite the sales process. It may include the cost to generate documents and send them to different physical locations, if necessary.

Miscellaneous. These costs amount from sent faxes, photocopying, prints, and other additional costs that are similar in nature. Miscellaneous costs are often paid by the seller but in some cases, the buyer might choose to contribute as well.

Home Warranty. Home warranties are annual service contracts to cover repairs and replacement of appliances in case they break down. Sellers are supposed to pay any pending warranties before the title is transferred to the buyer. The home warranty may also be transferred to the buyer after adjustments.

Prorated HOA dues. Prorated HOA dues are collected upfront by the homeowners association. The seller is supposed to pay the monthly HOA dues from the seller’s proceeds. For example, If the seller has paid $600 as HOA dues at the beginning of the month and the buyer moves in on the 10th of the month, the buyer will be charged $400 for the month. On the other hand, the seller’s account will be credited with $400 at the same time.

Prorated Taxes. Prorated taxes are deductions paid by the sellers in advance for the next few days or months. Even if the dates for tax payment and closing coincide, prorated taxes are deducted from the seller’s account and then adjusted afterward.

Recording Fees. Recording fees include chargers for making the deed and other legal documents. There are more than hundreds of documents across mortgage, deed, licenses, foreclosures, and other areas that can be recorded during closing. Recording fees could either be paid by the seller or the buyers. It totally depends on the mutual agreement between the two parties.

Repairs from Home Inspection. A home inspection is often the first step after buyers have expressed their interest in the property. A home inspection could reveal the need for some repairs. It is normative for sellers to pay repair charges to avoid giving the buyer any unpleasant surprises after the title is transferred in their name from the seller.

Revenue Stamps. Revenue stamps are required to legally transfer the title from the seller to the buyer. They are interchangeably called transfer costs and differ in value from one state to another. Here is a list of transfer costs across states. Most of the states charge around 0.1% to 0.3% of the transaction value, except for a few.

Survey Cost. Survey cost or called land survey cost is paid to the professional land surveyor who surveys the property premises to confirm the boundaries and contents of the land. The survey cost must be paid by the seller as an assurance of no existing dispute with the neighbors or nearby property owners before the buyer takes possession.

VA Required Fees. Veterans are not required to pay insurance on the mortgage. Instead, they can pay a one time fee for mortgage approval. If the buyer is a veteran, the seller is supposed to pay any pending insurance before updating the title into the buyer's name.

Appraisal. The seller must find out the current market value of their property before the deal takes place between them and the buyer. This calls for an appraiser to visit the property and create an appraisal sheet. Home appraisal costs can be paid by either of the parties, however, the seller pays this cost most of the time.

Home Inspection. Home inspections are necessary to check discrepancies in the properties that can amount to significant repair costs. It is better for sellers to initiate the home inspection process and pay for it as well.

Pest Inspection. Like home inspection, a pest inspection is better done by sellers themselves. A pest inspection determines the probability of damage or damage done by insects, bugs, termites, and dry rot.

Radon Inspection. Radon is a radioactive gas that can potentially create health complications in people. A seller must ensure that their property is free from Radon by getting a Radon inspection done.

Well and Septic Inspection Fees. It is necessary that the water system is working properly. An inspector checks the pressure and volume of the water system to ensure that it is in compliance with the construction guidelines.

Other Costs. In addition to the above costs, a seller may also incur costs such as flood certification. Flood certification is necessary if the property is located in a flood prone area.

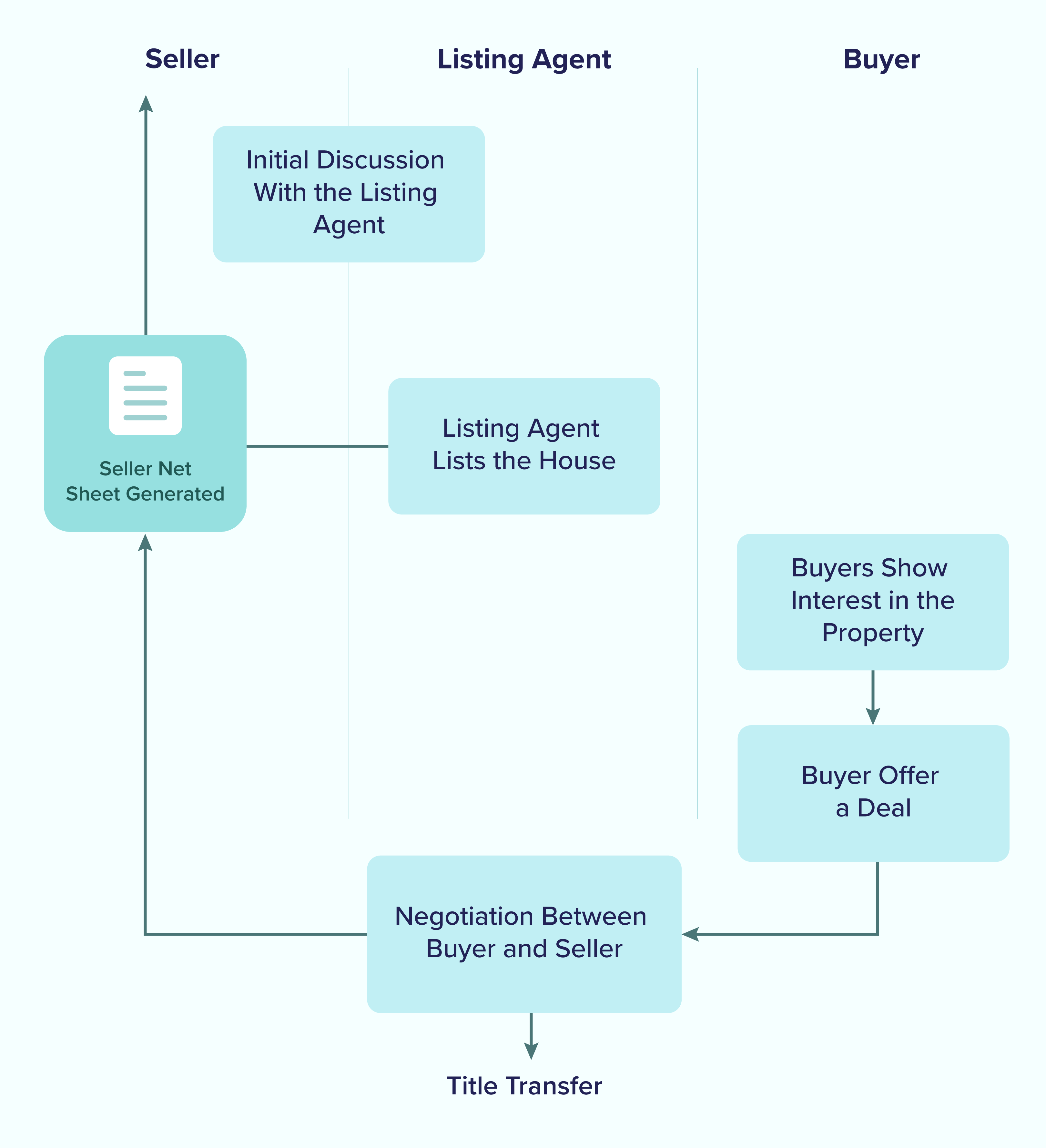

Who prepares the seller net sheet and when?

The seller net sheet is prepared by the listing agent most of the time. The listing agent is in touch with the seller and ideally prepares it well before they list the property across MLSs. However, in many states, the seller net sheet can also be prepared by the attorney during the final stages of the home closing process.

Additionally, a settlement agent may also provide the seller set sheet but it is rare.

The seller net sheet may be generated at multiple points in the home buying timeline. The seller and the listing agent can have an initial discussion and the listing agent can prepare it before listing the property.

It is also possible that the property is first listed to attract buyers. After a buyer has agreed to transact, the seller net sheet can be generated by the listing agent.

What are some free tools to calculate cost components in the seller net sheet?

Cloud CMA. Cloud CMA is a cloud based app that allows you to generate the seller net sheet with all the cost components in the list. The cloud CMA seller net sheet is quite insightful with customizable fields.

Costs First (First American). Cost first is one of the most popular free tools to put the seller net sheet together. Cost First does not provide additional customizations similar to cloud CMA but nonetheless, it gets the job done.

Fidelity Agent. Fidelity agent is a popular app that helps you generate buyer and seller estimates for your clients. The seller net sheet by Fidelity Agent is quite visual and demonstrates the figures using pie charts and graphs. You can also download their mobile app to generate the seller net sheet.

Elko. Elco is a popular web-based plugin that allows you to generate a seller net sheet in no time. The best thing about Elko is the ability to use it with your site to generate leads who are looking to close. Not only you provide your sellers free seller net sheets but also capture their details.

Seller net sheet is an important document that gives a clear perspective on the closing costs to the sellers. We hope you found the above post useful to understand the seller net sheet in detail.