Are you ready to step into eClosing to boost your business but feeling apprehensive about legal aspects of an electronic closing workflow? If yes, then this post will answer your questions.

The title and closing industry have been undergoing a digital transformation for some time now, and the current pandemic has accelerated the process further. New rules and regulations are being made to govern and validate electronic signatures, remote online notarizations, and eVaults that compose the working parts of an eClosing process.

While a lot of people in the title industry would love a fully digital closing process, they are equally perplexed by the legal implication of online closing. What is legal and what is not legal? What guidelines should they follow to create a reliable workflow that needs minimal intervention in the future? This is what we are going to discuss in this blog post.

We will learn about the 3 major parts in eClosing that come with their own legal implications and can potentially influence the workflows followed by title companies. We will talk about the ESIGN and UETA act that governs electronic signatures and also look at the current legal status of eNotarization. We will also look into eVaults and their importance in the entire legal framework for eClosing. So without further ado, let’s get started.

We are looking at three parts of the eClosing process when we talk about legal implications. These are:

- eSigning

- Remote Online Notarization (RON)

- eVaults

eSigning is the first part of the process that allows pdf versions of documents, such as closing disclosure and ALTA, to be signed electronically and accepted by the listing agent and the title company. But are these electronic signatures valid in the first place?

If you are asking the same question then the answer is Yes. There are two governing acts that validate electronic signatures. These are the ESIGN and UETA. According to them, an electronic signature is valid given that it satisfies a few pre requites.

The legality of electronic signatures

The ESIGN and UETA state that an electronic signature is valid when:

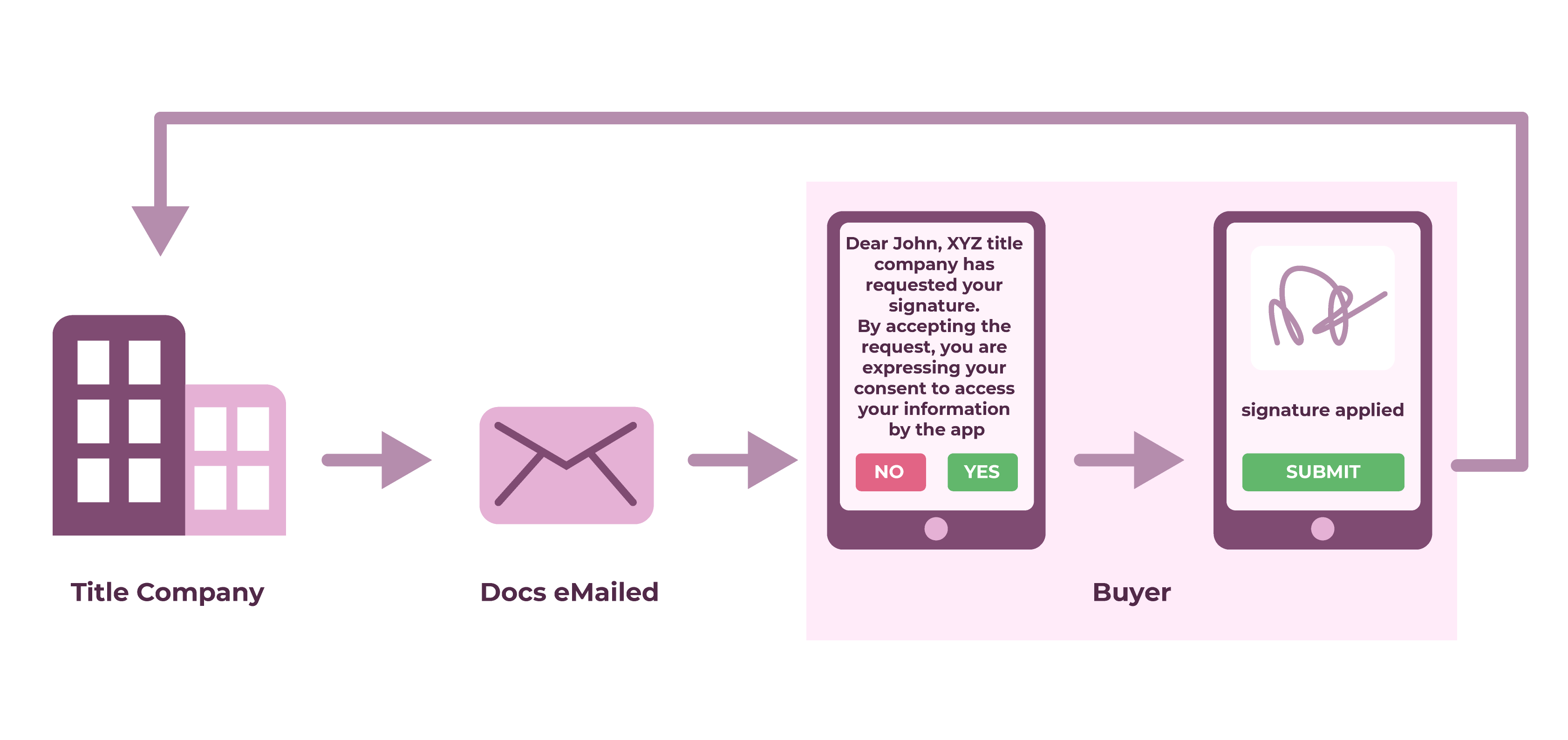

The parties have expressed consent to sign the documents. The consent is obtained from the signer using an accept/decline option to sign a document sent via email. The signature can only be applied if the signer accepts the request expressing his consent to sign the document.

Consent to conduct business operations electronically. Both UETA and ESIGN mandates that both parties express consent to conduct business electronically.

A lot like consent to sign, consent to do business electronically is also built into the workflow. Since the act also mandates that an opt out option be given, customers must not opt out or withdraw their consent for a transaction to be legal and accepted.

Opt out option. If you are a title company wanting your parties to sign electronically, you must provide then with an opt out option as well. You should also provide clear instructions for buyers or settlement agents who want to submit wet ink signatures instead.

It may also happen at times that you may want to withdraw your consent. In such cases, a withdrawal notice must be sent to the borrower.

Receiving Signed Copies. The borrower, lender, seller, and whichever party has signed the documents, must receive a copy of the signed document as the act mandates.

Permission to Record. The acts mandate that the signatures are recorded and be reproduced accurately in the future by parties who are legally entitled to do so. The majority of eSignature app companies have their own eVaults to save documents and signatures in the future. These documents are never removed from the database.

eSignatures are widely used in the home closing process. However, it comes with some limitations. eSignatures are only valid for a set of documents. You can verify the ALTA, Closing Disclosure, and some other documents using electronic signatures but there is a list of documents that require mandatory notarization. Notarization of documents online is possible but it follows a different set of guidelines altogether. Let’s look deeper into it.

Online Notarization

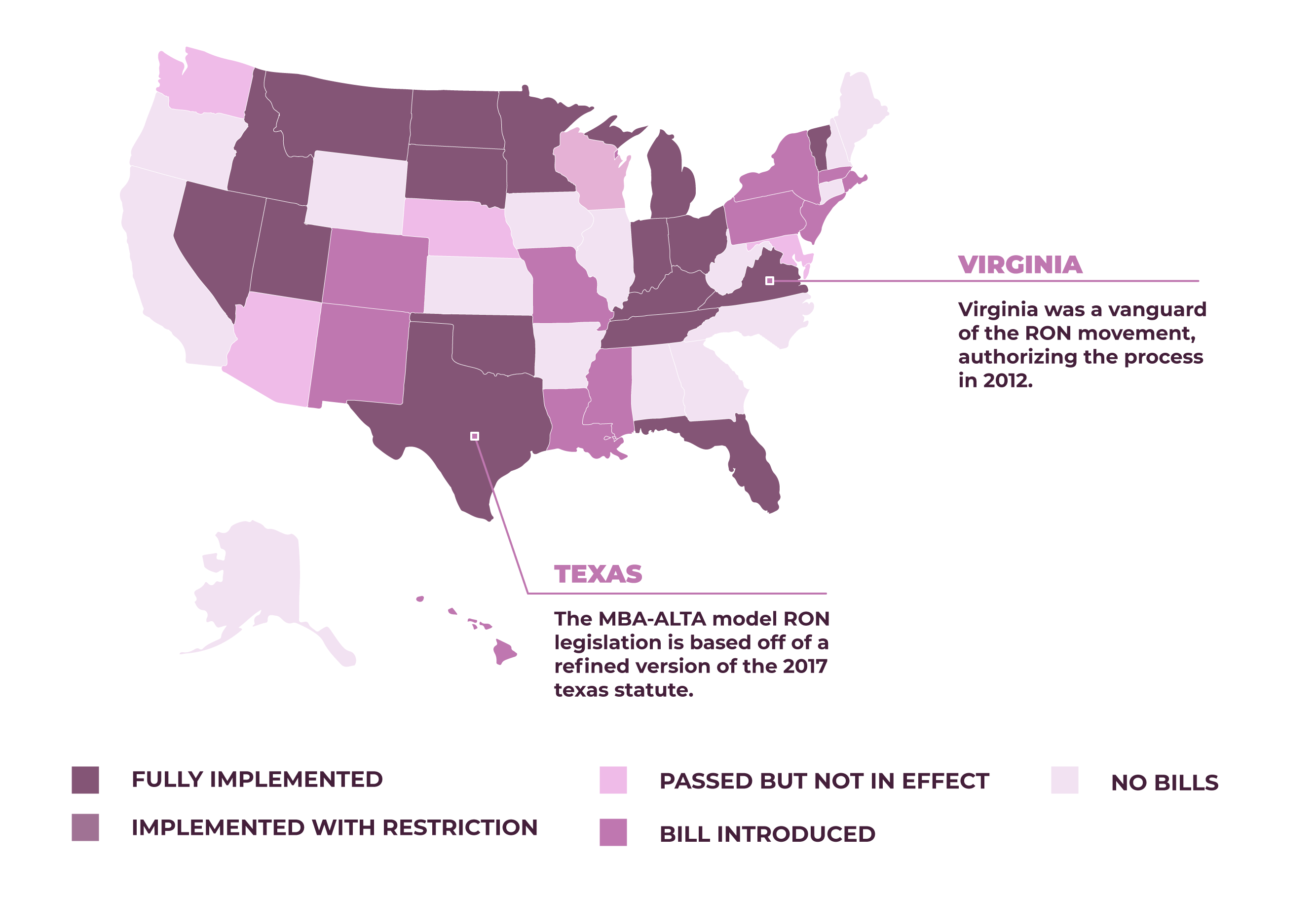

Online notarization has seen a fast adoption during the pandemic. However, a lot of states do not have provisions that allow 100% online notarization.

This is why eClosing largely remains a hybrid process with some parts being digital while other remaining conventional to date. But that is changing fast. Right now, around 16 states have gone ahead with full implementation of RON while 13-14 states have passed bills to implement it in the near future.

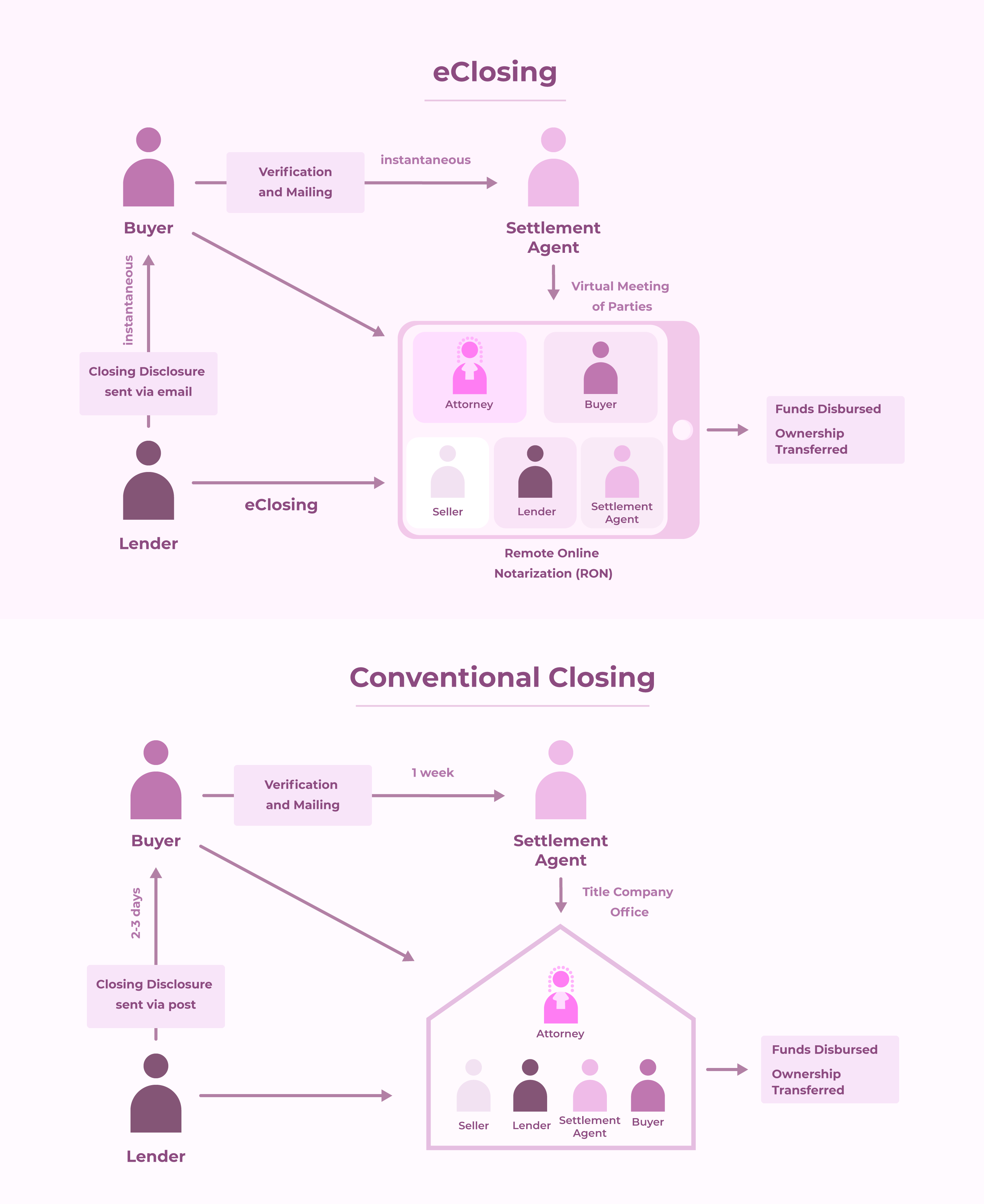

The process of remote online notarization is simple. Instead of the parties coming to the title insurance office they fix an online video call. All the participants including the buyer, seller, settlement agent, lender, and the attorney log in at the same time.

The documents required from the buyer and the seller are already electronically signed and verified by the lender. The consent of the parties is then taken into account by the attorney. The attorney then affixes the electronic seal of the title company on the deed. Once the seal is applied and the record is made, the funds are disbursed to the seller’s account and the buyer assumes the legal ownership of the property.

Remote online notarization has the potential to add a lot of value to the customer experience that can potentially boost the reputation of the title companies.

The last piece of the puzzle in eClosing is eVaults. eVaults are provided by multiple companies. An eVault is supposed to accurately reproduce the documents and the signatures whenever required. They are also supposed to safeguard the data and unauthorized access and editing. You need not worry about record keeping as it is managed by third party providers who comply with all the legal requirements.

eClosing is the future of real estate closing. Majority of states have started to clearly define legal frameworks for eClosing and we may not be too far from a fully operational eClosing experience across the US.