What is Title Insurance in New Jersey?

Title insurance is an important cost component within Closing Costs that always intrigues a first time home buyer. Title insurance in New Jersey protects buyers and lenders from financial liabilities that may arise due to a title defect or a hidden lien.

Have a look at our Title Insurance explainer video to see how title insurance can protect your lender and your ownership in case of a title defect.

There are two types of New Jersey title insurance policies: Lender’s Title Insurance Policy and Owner’s Title Insurance Policy.

Lenders in New Jersey often require borrowers to purchase a New Jersey Lender’s Title Insurance Policy which guarantees protection for New Jersey lenders against issues arising out of defects on the title of a New Jersey property. On the other hand, the New Jersey Owner's Title Insurance Policy protects the buyer against claims and liens.

Title insurance policy premiums in New Jersey show up as line items within a closing cost worksheet for a buyer and seller such as a Closing Disclosure, Loan Estimate, HUD-1, or an ALTA Settlement Statement. If you're looking to get a preview of what these costs look like, use this free New Jersey title, insurance calculator.

How much does Title Insurance Cost in New Jersey?

Like many states, the cost calculation is pretty straightforward in New Jersey. There are 4 slabs to calculate the title insurance cost in New Jersey.

A property worth $200,000 would cost around $950 as title costs. You should also add an additional $100 for the title examination. The cost of the loan policy remains a flat $25 for every mortgage regardless of its value.

Take note that this price does not include the cost of endorsements. Endorsements or liens on a property will cost further.

Here are some more use cases:

- For a purchase price of a $350,000 property in New Jersey with a 20% down payment ($70,000), the cost of a title insurance policy and lender's policy are $1,588 and $25 respectively.

- For a purchase price of a $350,000 property in New Jersey bought with full cash, the cost of the title insurance owner's policy is $1,588.

- For a purchase price of a $500,000 property in New Jersey with a 20% down payment ($100,000), the cost of title insurance owner's policy and lender's policy are $2,225 and $25 respectively.

- For a purchase price of a $500,000 property in New Jersey bought with full cash, the cost of the title insurance owner's policy is $2,225.

- For a purchase price of a $1,000,000 property in New Jersey with a 20% down payment ($200,000), the cost of title insurance owner's policy and lender's policy are $3,600 and $25 respectively.

- For a purchase price of a $1,000,000 property in New Jersey bought with full cash, the cost of the title insurance owner's policy is $3,600.

How to Calculate Title Insurance for New Jersey?

Like we have mentioned, there are 4 price slabs that decide the title insurance cost. These are:

| Property Rate | Cost per $1000 |

| $0 - $100,000 | $5.25 |

| $100,001 - $500,000 | $4.25 |

| $500,001 - $2 million | $2.75 |

| Over $2 million | $2.00 |

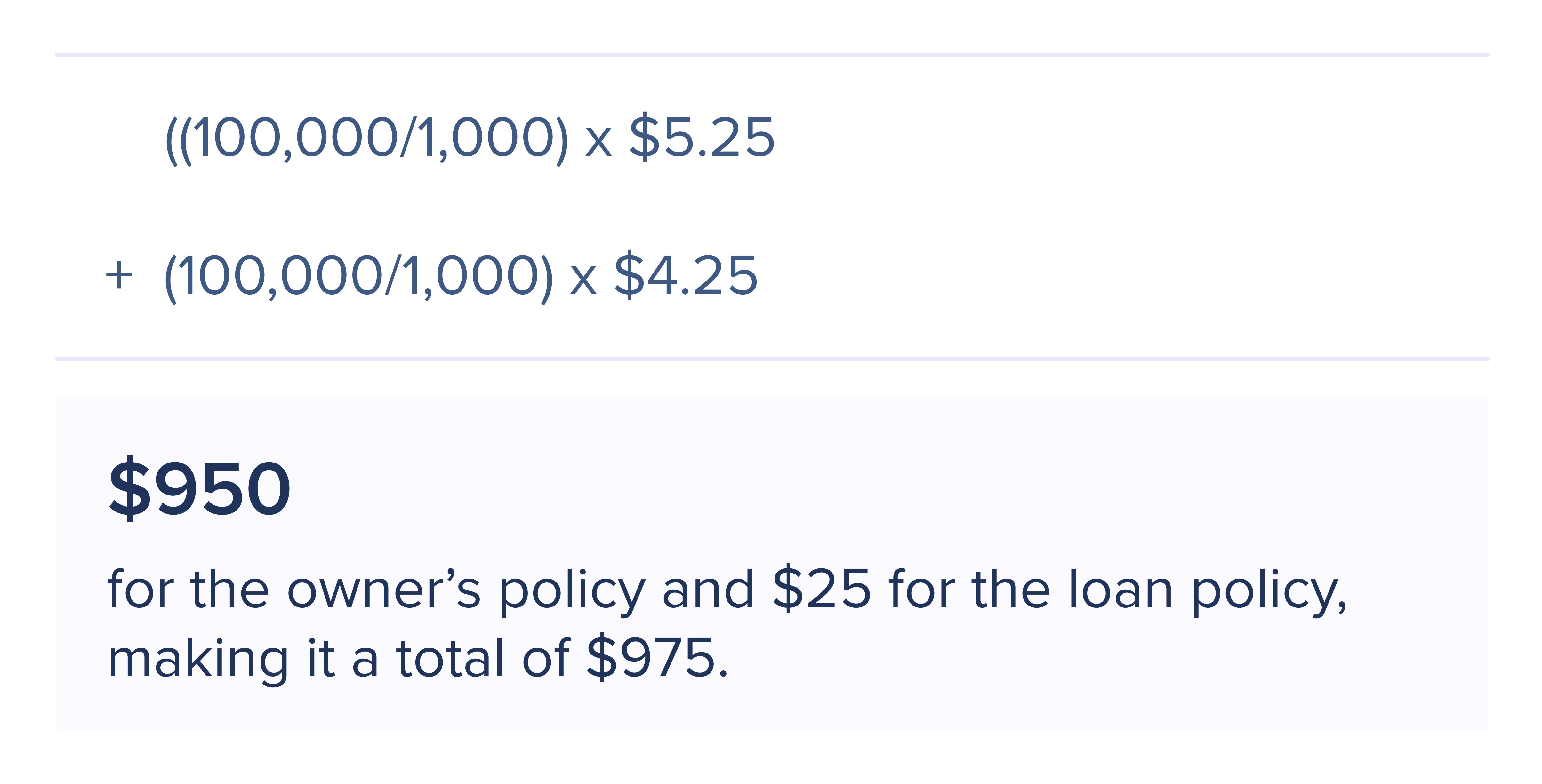

Say you want to calculate the cost of the owner's title policy for a $150,000 property. The total cost will be:

What is the Owner's Policy in New Jersey?

The owner's policy is the last line of defense that protects the owners against unknown defects such as missing heirs, incorrect documentation, and unjust court proceedings. If you have an owner's policy, all that would be taken care of, and your ownership will remain protected.

This is why it is always best to go for title insurance irrespective of the fact that it is mandated by the state or not.

What is Lender’s Title policy in New Jersey?

The lender’s policy is often purchased along with the owner’s policy. It protects the lender from title defects such as a pending construction lien on the property, errors in the title, and other issues that may arise after the title has been transferred to the buyer.

What is not covered in Title Insurance in New Jersey?

Title insurance may not cover the following:

- Financial losses due to inadequate property inspection.

- Infestation

- Damages due to natural calamities such as thunderstorms.

- Damage due to a fire

How long is the title policy valid in New Jersey?

The title policy remains valid till the time you remain the owner of the property. Only when you decide to sell, a new policy must be made in the name of the buyer. The lender’s policy is valid till the mortgage is paid back.

Is Title Insurance regulated in New Jersey?

Yes. The Office of Property and Casualty, which is the insurance division of the Department of Banking and Insurance, regulates the price of title policies in New Jersey. It ensures that the title rates do not change from one title company to other.

Who Pays for Title Insurance in New Jersey?

The buyer usually pays for both Owner’s and Lender’s title policy in New Jersey. As mentioned, the lender's policy protects the lenders from claims or liens, etc., while the owner's policy protects the ownership of the buyer from unforeseen issues such as missing heirs or losses from an unfair decision from a court.

Is Title Insurance necessary in New Jersey?

Yes, title insurance is a must have for every buyer buying properties in any part of NJ. This is because the land and the property may have various rights that might be diversified across multiple owners. For example, if property taxes are pending for the property, the government can have a lien against it without the new owner ever knowing about it.

However, if the incoming new owner opts for title insurance, these discrepancies will be revealed during the title search, cautioning, and preventing them to sign the papers.

Should you shop for title insurance in New Jersey?

You can definitely shop for title insurance in the state of New Jersey by approaching any reputable title company. However, if you are skeptical, you can ask your agent or lender to help you out with the process.

Can you negotiate Title Insurance Costs?

Most of the time, title insurance fees are not negotiable. What buyers can do is ask their agents for them to negotiate and let sellers pay the amount. In some cases, if the property is being resold in less than 5 years of time, title insurance costs could be waived off.